Can You Get Stimulus if You Owe Taxes

By Christine Tran, 2022 Get Information technology Back Campaign Intern

In 2022, you can visit GetYourRefund.org to claim whatever stimulus checks you lot haven't gotten . Y'all volition need to file a 2022 revenue enhancement render to get the beginning and second stimulus checks and a 2022 revenue enhancement render to get the third stimulus bank check.

If you didn't become your kickoff, 2d, or tertiary stimulus check, don't worry — you can still merits the payments as a taxation credit and get the money every bit part of your taxation refund. The stimulus checks are a federal tax credit, known equally the Recovery Rebate Credit. Y'all volition need to file a revenue enhancement render to go the Recovery Rebate Credit.

How do I claim the Recovery Rebate Credit on my tax render?

You tin become the Recovery Rebate Credit by filing your taxes. The tax return yous demand to file will depend on which stimulus checks y'all need to get. Regardless of which taxes you must file, you can visit GetYourRefund.org to file your taxes for gratuitous.

Get-go and Second Stimulus Check

You will need to file a tax return for Taxation Year 2022 (which you file in 2021). The deadline to file your taxes this yr was May 17, 2021. The revenue enhancement filing extension deadline is Oct fifteen, 2021.

If you missed the filing deadline, you can still file your revenue enhancement render to become your first and 2nd stimulus checks. If you don't owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject field to penalties and fines for non filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you lot owe and other federal and state debts.

To learn more virtually your options if you think you owe taxes, read "Filing Past Due Tax Returns" and "What to Do if I Owe Taxes simply Can't Pay Them."

Third Stimulus Check

Yous will demand to file a tax return for Taxation Yr 2021 (which you lot file in 2022). The deadline to file your tax render is Apr eighteen, 2022.

Filing Your Taxes

Revenue enhancement software, such as MyFreeTaxes, H&R Block, or TurboTax, volition automatically assist determine if you authorize for the Recovery Rebate Credit.

If your income is nether $72,000, you can use IRS Free File to ready and file your federal income taxes online for gratis. If you earn less than near $56,000, you tin can as well utilize the IRS VITA Locator tool or visit AARP Foundation Tax-Aide to find a free revenue enhancement site near you during the tax season.

If you received your outset, second, and/or third stimulus cheque, you'll need to know the amount y'all got for each check. If you need aid finding the amount of your checks, click here. If you haven't received your stimulus checks, you volition be asked questions to assist ostend your eligibility and the amount you lot are owed.

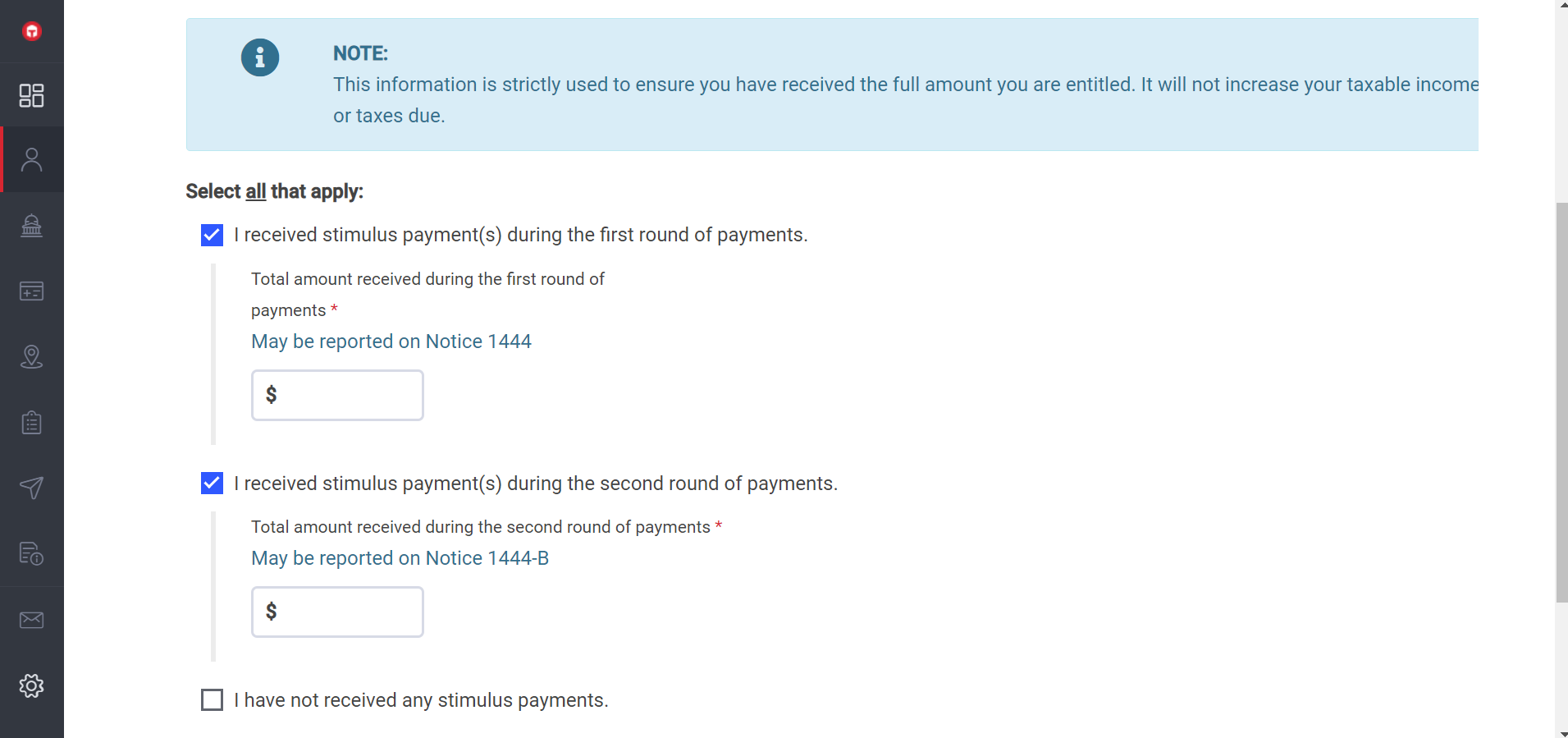

This is an example of how to claim the Recovery Rebate Credit through MyFreeTaxes tax software.

The following sections provides information about who may need to file to get each of the stimulus checks.

Starting time Stimulus Check

If you did not qualify for the first stimulus check based on your 2022 or 2022 taxes, you tin merits the Recovery Rebate Credit if you are eligible based on your 2022 tax return (which you lot file in 2021).

Hither are some situations where yous may need to take action to go the offset stimulus check:

- If you lot were claimed as a dependent on someone else'south 2022 tax return (see Q C6), yous were non eligible for a stimulus check. Still, if that changed in 2022 and you meet the other eligibility requirements, you tin can claim the credit on your 2022 federal taxation return (which you file in 2021).

- If you are incarcerated and did not receive your commencement stimulus check, y'all can claim the tax credit on your tax render.

- If your family was denied a stimulus cheque considering only i spouse has a Social Security Number (SSN), that dominion has at present inverse. The spouse with the SSN and qualifying children with SSNs tin can claim the first stimulus bank check equally the Recovery Rebate Tax Credit. If you're a military family, simply one spouse needs to have an SSN forboth spouses to claim the first stimulus check.

- If your showtime stimulus bank check didn't reflect all or your qualifying dependents (meet Q C5) or if your income decreased in 2022 and y'all but received a partial stimulus check because of your 2022 or 2022 income (run across Q B11), you can claim the additional money past filing a 2022 taxation render (which you file in 2021).

Second Stimulus Bank check

If y'all did not qualify for the second stimulus check based on your 2022 taxes, you can claim the Recovery Rebate Credit if y'all are eligible based on your 2022 tax return.Please note that some of the second stimulus bank check eligibility rules differ from the first stimulus check.

Hither are some situations where you may need to take action to become the 2d stimulus check:

- If you were claimed as a dependent on someone else's 2022 taxation render, you were not eligible for a stimulus check. Yet, if that changed in 2022 and you meet the other eligibility requirements, you can claim the credit on your 2022 federal revenue enhancement return (which yous file in 2021).

- If your second stimulus bank check was sent to a depository financial institution account that is closed or no longer active, the IRS volition not reissue the payment by mail. Instead, you will have to file a 2022 tax return to the claim the payment as the Recovery Rebate Credit.

- If your second stimulus check didn't reverberate all of your qualifying dependents or if your income decreased in 2022 and you only received a partial stimulus check based on your 2022 income, you can claim the additional coin when you file a 2022 federal revenue enhancement return.

Third Stimulus Bank check

If you did not qualify for the 3rd stimulus cheque based on your 2022 or 2022 taxes, you can claim the Recovery Rebate Credit if you are eligible based on your 2022 tax return.

Here are some situations where you lot may need to accept action to get the third stimulus check:

- If you were claimed every bit a dependent on someone else's 2022 revenue enhancement return, yous were not eligible for a stimulus cheque. However, if that changed in 2022 and you lot meet the other eligibility requirements, you lot can claim the credit on your 2022 federal tax render (which y'all file in 2022).

- If your third stimulus bank check was based on your 2022 return or data received from Social Security Administration, Railroad Retirement Lath, or Veteran Affairs and y'all did not get the right amount.

- If your third stimulus check didn't reflect all your qualifying dependents or if your income decreased in 2022 and you only received a fractional stimulus check because of your 2022 or 2022 income, you could claim the additional coin when you lot file your 2022 federal tax return (which you file in 2022).

Finding the amounts of your beginning, second, and third stimulus checks

To find the amount of stimulus payment(due south) you've received, you lot can:

- Refer to the IRS notices that were mailed to you.IRS Notice 1444shows how much you received from the first stimulus cheque.IRS Discover 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you lot received from the third stimulus cheque.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and tertiary stimulus check using your bank statements. They should be labeled as "IRS TREAS 310" and have a code of either "TAXEIP1" (commencement stimulus check), "TAXEIP2" (second stimulus bank check), or "TAXEIP3" (tertiary stimulus check).

- Request an account transcript. You lot can request an business relationship transcript sent electronically or past mail using Get Transcript. Y'all can also call the IRS' automated phone transcript service at 800-908-9946 or mail in Class 4506-T to take your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus bank check amounts under the Revenue enhancement Records tab. If you filed jointly with your spouse, you volition only see your half of the stimulus cheque amounts. Your spouse will need to sign into their own account to see the other one-half of the stimulus check amounts.

To create an account, you will demand:

- Bones information: full proper name, electronic mail, altogether, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), tax filing status, and current address.

- A number from Ane of your financial accounts such as the terminal eight digits of your VISA, Mastercard, or Observe credit cardorthe loan business relationship number of one of the following types of loans: educatee loan, mortgage loan, abode equity loan, domicile equity line of credit, OR an machine loan.

If the above options don't work for you, you can provide the amount of your stimulus checks based on retention. The IRS will correct the amount for you if you make a mistake, which may delay the processing of your tax return. The IRS will notify yous of any changes made to your tax return.

If you lot are doing your taxes without the help of software, yous can use the Recovery Rebate Credit Calculation Instructions here (get to Step 3 and click "Didn't get your full stimulus check?").

When volition I get the Recovery Rebate Credit?

You will well-nigh probable get the Recovery Rebate Credit equally part of your tax refunds. If you electronically file your tax return, you lot will likely receive your refund within 3 weeks. If y'all mail your return, information technology can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will non delay your revenue enhancement refund. Nevertheless, if you don't merits the correct corporeality of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS volition send you a notice of any changes fabricated to your render.

You can check on the status of your refund using the IRS Cheque My Refund Status tool.

Click here to learn how to get your stimulus checks.

Need help with claiming the Recovery Rebate Credit?

This Free Tax Filing page tin can help you find the all-time resource to file your taxes for free.

hatfielddouse1959.blogspot.com

Source: https://www.taxoutreach.org/blog/what-do-i-do-if-i-didnt-get-my-stimulus-check-in-2020/

0 Response to "Can You Get Stimulus if You Owe Taxes"

Post a Comment